Back in 2018, cigarette maker Altria—formerly known as Philip Morris— apparently saw the writing on the wall for the tobacco industry's future. In December of that year, the company dropped a cool $12.8 billion to gain a 35 percent minority stake in e-cigarette firm Juul. The Juul deal seemed like a particularly clever way to gain a massive toehold in the vaping market as traditional tobacco cigarette use waned—too clever, it seems, as now the Federal Trade Commission is suing to unwind the deal.

The transaction "eliminated competition in violation of federal antitrust laws," the FTC said yesterday, announcing the unanimous vote to move forward with the suit.

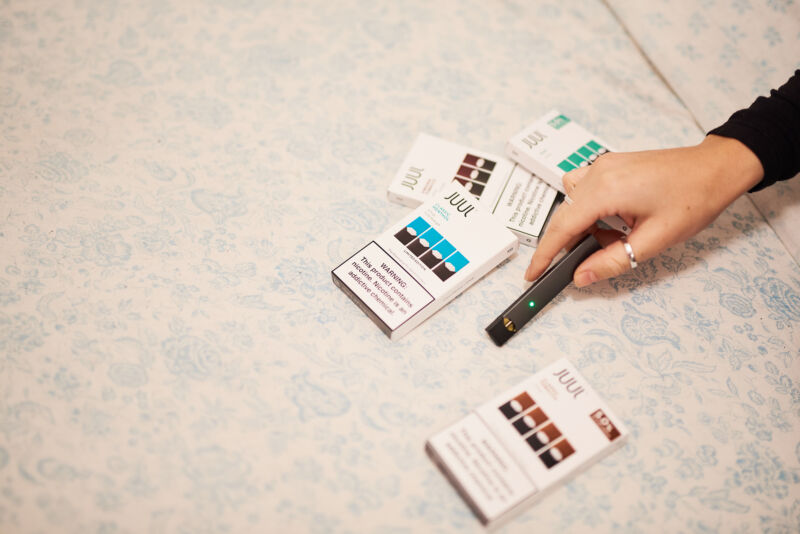

At the time of the acquisition, Juul was the leading US e-cigarette brand, the FTC alleges, but Altria's own MarkTen product was already the second most popular brand by market share. Instead of continuing to compete, however, Altria arranged to reap the benefits of its competitor without outright acquiring it.

"Altria orchestrated its exit from the e-cigarette market and became Juul's largest investor," Ian Conner, director of the FTC's bureau of competition, said. "Altria and Juul turned from competitors to collaborators by eliminating competition and sharing in Juul's profits."

Altria, for its part, intends to "vigorously defend" the deal. "We believe that our investment in Juul does not harm competition and that the FTC misunderstood the facts,” Altria general counsel Murray Garnick said. "We are disappointed with the FTC's decision, believe we have a strong defense, and will vigorously defend our investment."

A beleaguered buy

Altria's rebranding in 2003 followed the massive "Big Tobacco" suits in the 1990s. Although the tobacco firms fought for decades over meeting some of the settlement terms they agreed to, the reputational damage the cigarette industry sustained in the opening years of the 21st century was both deep and broad.

While more than 40 percent of Americans were cigarette smokers in the 1960s, that figure had dropped to an all-time low of 13.7 percent by 2018. What we had instead, however, was a massive surge in e-cigarette use, or vaping. In 2017, about 11 percent of high school seniors reported using e-cigarette products containing nicotine. By 2018, that figure was 21 percent, and it rose to 25 percent last year.

Through 2019, however, Juul began to find itself in trouble with federal regulators. The Food and Drug Administration in September blasted Juul for allegedly advertising directly to students in schools without parental consent. A week later, the company pulled all its advertising and fired the CEO.

A whistleblower lawsuit and the tangle with regulators ended up hitting the company's bottom line as well. In October, along with its third-quarter results, Altria announced a $4.5 billion write-down on its Juul investment. The fourth quarter was no better: in January, Altria wrote down another $4.1 billion of its investment, estimating Juul's overall valuation to be about $12 billion—less than that 35 percent stake was worth a mere year earlier.

reader comments

41